Understanding Behavioural Economics to Enhance Insurance Offerings

Understanding Behavioural Economics to Enhance Insurance Offerings

Key Principles of Behavioural Economics

Core Concepts

1. Loss Aversion: This principle suggests that individuals experience losses more intensely than gains of the same size. In the context of insurance, consumers may be more motivated to purchase coverage to avoid potential losses rather than to gain benefits from the policy itself. This understanding can guide insurers in framing their products to emphasise risk mitigation.

2. Decision Fatigue: As consumers are faced with numerous choices, their ability to make sound decisions diminishes over time. This phenomenon can lead to suboptimal choices regarding insurance products. Insurers can simplify options and streamline decision-making processes to combat decision fatigue.

3. Framing Effects: The way information is presented can significantly influence consumer choices. For instance, presenting a policy as having a “90% success rate” rather than a “10% failure rate” can lead to different perceptions and decisions among potential buyers. Insurers can leverage framing techniques in marketing communications to enhance product appeal.

These principles highlight how behavioural insights can shape consumer choices in the insurance sector, ultimately guiding product design and marketing strategies.

Applying Behavioural Economics to Insurance Products

Strategies for Incorporation

Simplification of Offerings: By reducing the complexity of insurance products and clearly communicating their benefits, insurers can help consumers make informed decisions without feeling overwhelmed.

Use of Nudges: Nudges are subtle prompts that encourage specific behaviours without restricting choices. For example, insurers might implement default options for coverage levels that align with common consumer preferences, thus increasing uptake rates.

Personalisation: Tailoring products based on individual consumer data can enhance engagement. For instance, using telematics in auto insurance allows for personalised premiums based on driving behaviour, appealing directly to consumers’ desire for fairness and relevance in pricing.

Successful Examples

Progressive Insurance: By using telematics technology, Progressive offers personalised premiums based on driving habits. This rewards safe driving and aligns with consumers’ desire for individualised pricing based on behaviour.

Lemonade Insurance: Lemonade employs a unique business model that incorporates behavioural insights by using a flat fee structure and donating unclaimed premiums to charity. This approach resonates with socially conscious consumers and encourages them to act in ways that minimise claims.

These examples illustrate how understanding consumer psychology can lead to innovative product offerings that better meet customer needs.

The Impact of Behavioural Insights on Policyholder Behaviour

Enhancing Retention Rates

Understanding customer psychology is crucial for improving retention rates among policyholders. By employing behavioural insights, insurers can create loyalty programmes or incentives that encourage long-term engagement:

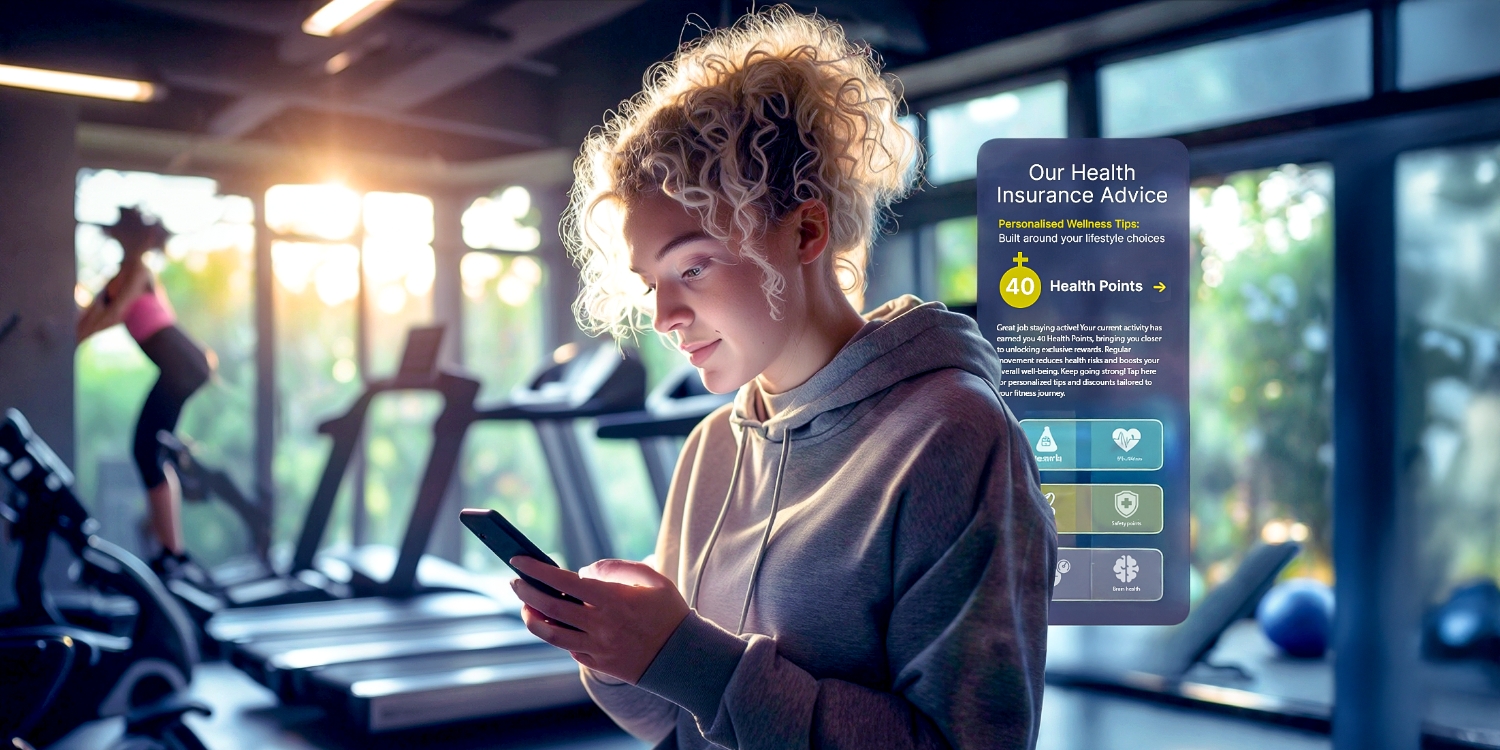

Incentivising Safe Behaviours: Programmes that reward policyholders for safe driving or healthy lifestyle choices promote positive behaviours and build a sense of loyalty toward the insurer.

Regular Communication: Engaging customers through regular updates about their policies or offering educational content related to risk management can strengthen relationships and reduce churn rates.

The Role of Nudges and Incentives

Opt-out Mechanisms: Implementing automatic enrolment in beneficial programmes (like wellness initiatives) while allowing customers the option to opt out has been shown to increase participation rates significantly.

Feedback Loops: Providing customers with feedback on their behaviours (like driving habits) can motivate them to improve their practices, thereby benefiting both the insurer and the insured.

By leveraging these strategies, insurers can create an environment that creates positive behaviours among policyholders while simultaneously enhancing customer satisfaction.

Case Studies: Successful Applications of Behavioural Economics in Insurance

Allstate’s Drivewise: This programme uses telematics data to provide feedback on driving habits and rewards safe drivers with discounts. By aligning incentives with desired behaviours, Allstate has seen increased customer engagement and satisfaction.

MetLife’s MyJourney App: MetLife developed an app that helps users track their health goals and offers rewards for achieving milestones. This approach engages customers and promotes healthier lifestyles, aligning with broader public health objectives.

Lessons Learned

Consumer-Centric Design: Products designed with consumer behaviour in mind are more likely to succeed in the market.

Continuous Evaluation: Regular assessment of behavioural strategies is essential for ensuring they remain effective and relevant over time.

The impact of these applications on customer satisfaction and policy uptake underscores the value of integrating behavioural economics into insurance practices.

Leveraging behavioural economics offers insurers a powerful framework for enhancing product design and marketing strategies. By understanding consumer behaviour through principles such as loss aversion, decision fatigue, and framing effects, insurers can create more appealing offerings that resonate with diverse consumer segments. Encouragingly, case studies demonstrate that successful applications of these insights lead to improved customer engagement, retention rates, and overall satisfaction. Embracing behavioural economics is a necessity for creating truly customer-centric insurance products in today’s market.